It's complicated. We can help.

Sweeney Conrad works with companies in Portland and across Oregon to assist with international tax compliance, planning and filing needs. International tax is an area that is under constant review by both domestic U.S. and foreign market officials. From a compliance perspective, there are various filings that must be made to make initial and maintain ongoing compliance with tax authorities. It's important to understand the filing requirement may extend beyond the corporation to individual business owners as well. As you can imagine, compliance is imperative, as there can be significant penalties for failing to comply with local regulations. In addition, attention and care should be given when structuring foreign transactions to ensure a minimal tax rate and that all relevant foreign tax credits and incentives are realized.

Our team of seasoned advisers work with US corporations expanding overseas, individuals investing abroad, foreign corporations entering the US and foreign individuals investing in US companies, securities or securities. In other words, we have the experience and knowledge to guide clients through the most complicated international tax situation.

Oregon Depends on World Markets

International Tax Services

Our team can assist Portland and other Oregon companies with the following international tax services, including:

- Assist clients with structuring cross-border transactions in the most tax-efficient manner.

- Assist foreigners that come to the U.S. to conduct business or invest in U.S. assets.

- Assist U.S. businesses with foreign operations

- Structuring of foreign investment in the United States and U.S. investments abroad

- Tax planning as it relates to double-taxation, foreign tax credits, income tax treaties, foreign earned income exclusion, expatriation, and dual-residency filing

- Foreign trusts, estates, and foundations

- Receipt of foreign gifts and inheritance

- Voluntary disclosure.

- Outbound cross-border transactions; income tax treaty interpretation

- Help individuals working or retiring abroad maintain citizenship through fulfilling tax obligations.

- Tax reporting and compliance in an ever-changing and complex environment

- Capitalize on tax holidays and incentives

- Cash repatriation to increase cash flow ad liquidity

- Global intangible low tax income (GILTI) calculations

- Foreign-derived intangible income (FDII)

- Foreign bank account reporting (FBAR)

- IC-DISC- a great incentive for U.S. companies with significant export activities

- Foreign Interest in Real Property Tax Act (FIRPTA)

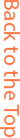

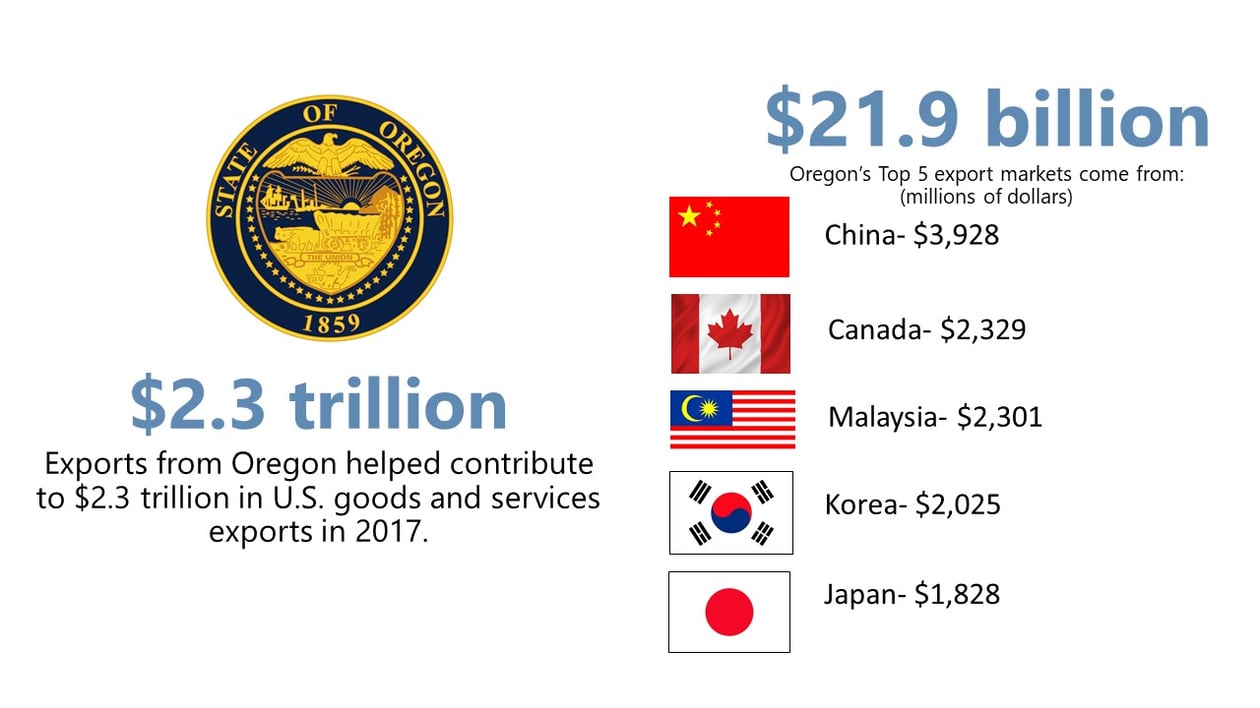

Oregon Foreign Exports

*Prepared by the Office of Trade and Economic Analysis, International Trade Administration, U.S. Department of Commerce.

A Global Network at Your Fingertips

Your business might be based in the Pacific Northwest, but as we become an increasingly global society, your audit, tax, and advisory needs may reach beyond the borders of our region, and even outside the United States.

We partner with nearly 200 firms in 42 states and 71 countries through Allinial Global, an association of legally independent accounting and consulting firms who understand the current competitive business climate. This provides us access to a broad array of resources, knowledge, and best practices so we can serve growth-minded businesses in all sectors and industries, and address both your national and international needs.